Investing in serviced apartments

The Sun 12/8/2005 Sujartha Kumarasamy

K DINESH and his fiancé are a typical young couple --

both are urban professionals looking for a starter home that would fit their

lifestyle. After weighing their options, they decided on a unit in the

Millennium Residence Smart Serviced Apartments, located on a 4-acre plot in

Section 14 in Petaling Jaya.

The

couple is an example of the demographic make-up of purchasers of serviced

apartments in the country. But this was not the scenario when serviced

apartments were first introduced in the late 1980s. Historically, says

Malathi Thevendran (pix, right), managing director of Jones Lang

Wootton Sdn Bhd, serviced apartments were built as an alternative to hotels. The

couple is an example of the demographic make-up of purchasers of serviced

apartments in the country. But this was not the scenario when serviced

apartments were first introduced in the late 1980s. Historically, says

Malathi Thevendran (pix, right), managing director of Jones Lang

Wootton Sdn Bhd, serviced apartments were built as an alternative to hotels.

Since they featured more space, these apartments were preferred by

long-term staying guests. One of the first serviced apartment developments,

completed in 1988, was the 242-room Micasa Serviced Suites by Tan & Tan

Developments Bhd, now owned by IGB Corp Bhd.

These hotel-type serviced apartments, says Malathi, are generally

retained by the developers, while operators are engaged to provide services.

"They are mainly occupied by expatriates or out-of-state locals that come to

the city for work on short-term assignments."

Liza Ong, marketing communications manager for Micasa Service Suites,

confirms this. "The majority of guests in our all-suites hotel are from the

corporate sector, with 20% staying for longer than one month." With an

average daily room rate of RM210.

Changing clientele

These

days, however, serviced apartments that are mushrooming in the Klang Valley

have attracted a different crowd -- individual investors and home buyers.

These serviced apartments are also referred to as serviced residences,

condos or suites. According to a CH Williams Talhar and Wong property report

last year, 2004 marked the launch of some 18 serviced apartment

developments, offering a total of almost 7,400 units. These are expected to

be completed in stages through 2008. These

days, however, serviced apartments that are mushrooming in the Klang Valley

have attracted a different crowd -- individual investors and home buyers.

These serviced apartments are also referred to as serviced residences,

condos or suites. According to a CH Williams Talhar and Wong property report

last year, 2004 marked the launch of some 18 serviced apartment

developments, offering a total of almost 7,400 units. These are expected to

be completed in stages through 2008.

What is a serviced apartment, anyway? According to Luxor Properties Sdn

Bhd, the developer of Millennium Residence, it refers to apartments built on

commercial land, which features some form of service like housekeeping or

concierge. "It is usually let out on a short- or long-term basis. However,

it is not uncommon for owners to occupy these units themselves," says Luxor

Properties' general manager Yong Wee Cheok (pix, left).

Charmaine Lim (pix, right), director of Titijaya Group, holds a

similar view. Most serviced apartments, she says, have evolved from their

original incarnation as places with hotel-like services into condo-like

developments. Buyers now plan to reside in them. "Services today are mainly

just housekeeping and laundry, and not full services," she adds. Titijaya is

building two such developments, e-tiara and tiaraville, both in Subang Jaya.

Malathi, however, cautions that there is no clear definition by the

authorities on serviced apartments. "Each developer seems to have its own

definition," she points out.

"What makes it different from a regular apartment or condo is the fact

that serviced apartments are built on commercial titles instead of

residential land. As the costs for commercial land are high, serviced

apartment units are typically smaller and priced at between RM300 and RM550

psf. In some instances, the prices have been higher, depending on the

location and reputation of the developer," adds Malathi. This is certainly

true -- the price for one of the 607 units at The Marc in Jalan Pinang,

which is in the KLCC area, has been quoted at RM909 psf in the WTW Property

Report.

Two

factors have propelled the boom in this property type. Malathi opines that

owners of commercial plots in the city centre have shifted their interest to

developing serviced apartments due to the oversupply of office space. Luxor

Properties' Yong confirms this, saying that the shift towards serviced

apartments only happened after the 1997/98 Asian financial crisis, when

demand for office and retail space declined sharply. Two

factors have propelled the boom in this property type. Malathi opines that

owners of commercial plots in the city centre have shifted their interest to

developing serviced apartments due to the oversupply of office space. Luxor

Properties' Yong confirms this, saying that the shift towards serviced

apartments only happened after the 1997/98 Asian financial crisis, when

demand for office and retail space declined sharply.

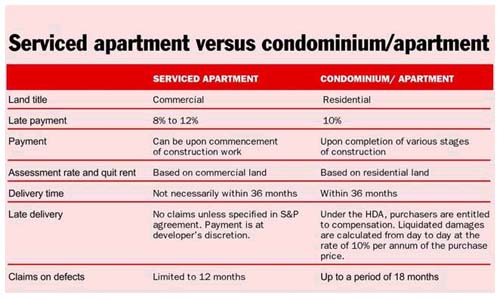

Siders Sittampalam (pix, left), a consultant with PPC

International, figures that serviced apartments allow develop ers to

navigate around the red tape that surrounds the strict guidelines of the

Housing Developers (Control & Licensing) Act 1966 (HDA). Since serviced

apartments are not governed by HDA rules, developers do not have to comply

and thus save time and money. "Developers can start selling serviced

apartments upon getting their building plans approved. They don't have to

wait for the sale and advertising permits and pay a substantial deposit for

a housing developer's licence," says Siders.

Growing allure

Building

on commercial land does not only benefit the developer, contends Low Gay

Teck (pix, right), managing director of Malaysia Land Properties

Sdn Bhd (Mayland). "Buyers also enjoy owning properties that have higher

rental values due to the fact that these provide more services like

housekeeping, laundry, and food and beverage. Some also provide broadband

Internet access, a service that may not be available in normal residential

properties." Mayland is the developer of 3,183 units of serviced apartments.

Two of its developments have been completed -- the 522-unit Mayfair &

Dorchester Serviced Apartments in Sri Hartamas and the 1,080-unit Prima

Regency in Johor. Building

on commercial land does not only benefit the developer, contends Low Gay

Teck (pix, right), managing director of Malaysia Land Properties

Sdn Bhd (Mayland). "Buyers also enjoy owning properties that have higher

rental values due to the fact that these provide more services like

housekeeping, laundry, and food and beverage. Some also provide broadband

Internet access, a service that may not be available in normal residential

properties." Mayland is the developer of 3,183 units of serviced apartments.

Two of its developments have been completed -- the 522-unit Mayfair &

Dorchester Serviced Apartments in Sri Hartamas and the 1,080-unit Prima

Regency in Johor.

For buyers, serviced apartments have an allure of their own. "Serviced

apartments are designed to house units with smaller built-up, and to cater

to a younger buying group. The bulk of the supply comes in the form of 1- to

2-bedroom apartments. Hence, such apartments would be ideal for young urban

professionals, singles or married couples with no children or those with

young children," says Yong.

"Moreover, the yields generated from some of the more popular

developments are in the range of 6% to 9%," says Malathi.

Siders explains that serviced apartments are targeted at a specific

segment of the market, particularly those who are looking to live in the

city. "Residents will enjoy proximity to the central business district, as

well as have access to a good public transport network and amenities."

Lim

says Titijaya's e-tiara and tiaraville serviced apartments have attracted

two different demographics -- young professionals who are single or with

small families, and retirees. "Our buyer profile includes retirees who are

attracted by the conveniences offered by our serviced apartments -- easy

access to transportation, housekeeping and laundry services and security. In

fact, we are also providing an in-house healthcare centre." Lim

says Titijaya's e-tiara and tiaraville serviced apartments have attracted

two different demographics -- young professionals who are single or with

small families, and retirees. "Our buyer profile includes retirees who are

attracted by the conveniences offered by our serviced apartments -- easy

access to transportation, housekeeping and laundry services and security. In

fact, we are also providing an in-house healthcare centre."

A Bangkok-based purchaser, Lau Tian Liang, agrees; he is among the

purchasers at e-tiara. "I had been looking around for an investment property

and this seemed to be a good one. It is also something that I do not mind

staying in." He is fully aware of the risks. "I understood `serviced

apartments' were not covered by the HDA, but I took the chances and put my

faith in the developer."

Investment vehicle

How does a serviced apartment rate as an investment vehicle? "A recent

survey by PPC International indicates that there are 3,867 units of services

apartment in various stages of development, including those on the drawing

board in the vicinity of KLCC," says Siders.

With such figures, can the rental market absorb the number of units

coming onstream? "This would lead to a question of whether in an oversupply

situation, will the market hold the yields expected from the investment when

they are not at a par with market expectations," he adds. In the long run,

Siders predicts that the capital appreciation for serviced apartments will

thin or even halt.

Serviced apartments might just appreciate in values, however. Malathi

cites some serviced apartments launched in 2000 and located in prime

locations, when the market was recovering from the late 1990s slump. "These

developments are experiencing capital appreciation of about 4% to 6% per

annum." says Malathi. "In terms of net yield, it ranges from 6% to 9% for

those located in prime locations and are well-supported by amenities."

Chang

Kim Loong (pix, right), secretary-general of the National House

Buyers Association (HBA), strongly cautions buyers to consider all aspects

of serviced apartments before purchasing. Potential buyers should review all

the documents, he says, from the marketing brochures, sale and purchase

(S&P) agreement, deed of mutual covenant and lease agreement, to the

termination terms before committing. This is because such purchases are not

governed by HDA. Besides the normal pitfalls of buying off-plans, buyers

will have to consider the commercial rates on taxes and utilities. For

investors, they have to consider the ease of getting tenants at the expiry

of lease agreements. Chang

Kim Loong (pix, right), secretary-general of the National House

Buyers Association (HBA), strongly cautions buyers to consider all aspects

of serviced apartments before purchasing. Potential buyers should review all

the documents, he says, from the marketing brochures, sale and purchase

(S&P) agreement, deed of mutual covenant and lease agreement, to the

termination terms before committing. This is because such purchases are not

governed by HDA. Besides the normal pitfalls of buying off-plans, buyers

will have to consider the commercial rates on taxes and utilities. For

investors, they have to consider the ease of getting tenants at the expiry

of lease agreements.

"The Act is actually a social legislation to protect buyers in their

dealings with housing developers. Any proposed development that does not

come under the definition of `housing accommodation' in the Act is outside

the legislative ambit. Therefore, no protection is accorded for buyers."

explains Chang.

In fact, Chang reminds buyers that even the Minister of Housing and Local

Government, Datuk Seri Ong Ka Ting, has publicly declared that there is a

loophole in the law and has repeatedly warned buyers to be aware that

"serviced apartments" are not covered under his ministry.

"Datuk Seri Ong has also announced that laws would be changed to cover

serviced apartments but no announcement has been made on when it will be

implemented," adds Chang.

Buyer beware

Malathi concurs with Chang. Since buyers are not protected under the HDA,

they should be extra cautious. "Buyers must read the agreement and

understand the services that will be included in the operations of the

building before signing the agreement," she says.

While Mayland's Low assures that "the purchaser's interest is clearly

protected in the S&P agree ment", purchasing a property that is outside the

jurisdiction of the HDA has its disadvantages, warns Siders. If something

goes wrong, the only legal recourse against the developer is the contractual

agreement between both parties as the properties are not regulated by the

HDA. This is why, says Low, purchasers should look at the track record of

developers and their experience in construction and management of hotels and

serviced apartments.

Malathi reminds buyers that the success of a serviced apartment is

dependent on the operations manager. "If there isn't a good manager on site,

the building can become `run-down' [due to the nature of the short-term

lets] and therefore, the value of the property goes down," she says.

It is also important, Malathi adds, that the right tenants or occupiers

are selected in order to sustain the quality or brand image of the

development. "In some instances, exclusive agents are appointed to manage

and select the occupiers."

Yong admits that as serviced apartments are not governed by the HDA, it

is not mandatory for such developments to comply with the provisions of the

Act. However, some developers, like Luxor Properties, draft their S&P

agreements based on the Act.

In the case of Millennium Place, the progress payment is upon completion

of the work done, although the stage of completion does not fully follow the

schedule stipulated in the HDA. For utilities, buyers will pay residential,

not commercial, rates. "As long as meters are applied for individually by

the purchasers under the residential category, then it'll be subjected to

the domestic tariff. For water charges, Syabas [Syarikat Bekalan Air

Selangor Sdn Bhd] has streamlined both commercial or domestic rates to a

single rate, with the only exception given to low-cost housing."

Lim

of Titijaya says buyers of e-tiara and tiaraville will also enjoy

residential tariffs. She adds that these days, many serviced apartments have

obtained approval so that the buyers are charged residential rates for

services. "It is quite easy to obtain residential rates as long as it is

proven that it will be for residential usage, instead of looking at the land

title of serviced apartments." Lim

of Titijaya says buyers of e-tiara and tiaraville will also enjoy

residential tariffs. She adds that these days, many serviced apartments have

obtained approval so that the buyers are charged residential rates for

services. "It is quite easy to obtain residential rates as long as it is

proven that it will be for residential usage, instead of looking at the land

title of serviced apartments."

Titijaya has gone one step further. "As we are a serious long-term

developer, we have opened a project account with our bridging loan

financier. This was before Bank Negara set this as a guideline for

developers building serviced apartments," adds Lim. The project account is

similar to an HDA account.

What is clear, then, is for home buyers to be aware of the benefits

offered by serviced apartments and weigh them against potential risks. While

buying a serviced apartment has its share of risk, Lau had this to say about

his serviced apartment purchase. "No investment is risk-free." |