How much should you pay a lawyer in a property

transaction?

08/09/2006 The Sun-Law & Realty By Andrew Wong

Before you

engage a lawyer to act for you in a property transaction, it is prudent to

ask the lawyer to give you an estimate of the legal fees and disbursements

that will be incurred to complete the transaction. This will prevent any

misunderstanding or dispute when the lawyer's bill is rendered for payment,

and will also allow you to know, from the outset, how much you will have to

set aside for this expenditure.

Legal fees for property transactions such as sale and purchase, loan,

banking facility and other non-contentious business are governed by the

Solicitors' Remuneration Order 2005 (SRO"). Some legal fees are of a fixed

sum ("fixed fee") and others are fixed by means of a scale ("scale fee").

In transactions where a fixed fee or scale fee is payable, a lawyer cannot

charge you more, unless there is special exertion involved or unless you

have entered into an agreement with your lawyer under section 114 of the

Legal Profession Act, 1976.

Special exertion means a transaction which is required to

be carried through by special exertion in an exceptionally short space of

time, and in such a case the lawyer is entitled to charge an additional fee,

over and over the fixed fee or scale fee, as the case may be.

A section 114 agreement must be in writing and may

provide for remuneration of the lawyer by a gross sum, or by commission or

percentage or by salary or otherwise, provided that such an agreement shall

not provide for costs at a scale lower than the fixed fee or scale fee.

Where there is no special exertion or no agreement in writing, the fixed fee

or scale fee is payable, and a lawyer cannot charge you less. This is often

referred to as the "No Discount Rule".

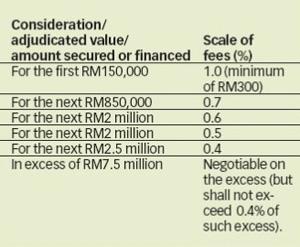

Currently,

the scale fees for property transactions, like sales, purchases or other

forms of conveyancing, and in respect of charges or mortgages, agreements

for financing under Islamic banking, debentures and other instruments of

security, are as follows: - Currently,

the scale fees for property transactions, like sales, purchases or other

forms of conveyancing, and in respect of charges or mortgages, agreements

for financing under Islamic banking, debentures and other instruments of

security, are as follows: -

In a case where the purchase transaction is governed by the Housing

Development (Control and Licensing) Act, 1996 ("HDA transaction"), or where

a loan is obtained to finance a HDA transaction, a lower scale of fees will

apply:

(a) RM250 if purchase price or the loan sum (as the case may be) is RM45,000

or below;

(b) 75% of the applicable scale fee specified above, if the purchase price

or the loan sum (as the case may be) is above RM45,000 but not more than

RM100,000;

(c) 70% of the applicable scale fee specified above, if the purchase price

or the loan sum (as the case may be) is above RM100,000 but not more than

RM500,000;

(d) 65% of the applicable scale fee specified above, if the purchase price

or the loan sum (as the case may be) is in excess of RM500,000.

For transactions where legal fees are not determined by a fixed fee or by

means of a scale, a lawyer may only charge a fee that is fair and reasonable

having regard to the circumstances of the case; the importance of the matter

to the client; the skill, labour, specialised knowledge and responsibility

involved on the part of the lawyer; the complexity of the matter or the

difficulty or novelty of the question raised; where money is involved, the

amount or value thereof; and the time expended by the lawyer. For such

transactions, there is all the more reason why you should ask for an

estimate of fees.

It is important for you to know that the fixed fee or scale fee includes

allowances for the time of the lawyer and his clerk and all usual and

necessary attendances, and also charges for normal copying and stationary.

If you are charged an additional sum for copying or stationary, you are

entitled to ask your lawyer for an explanation as to how these additional

charges have been incurred.

However, the fixed fee or scale fee do not include: registration fees on

documents requiring registration; stamp duties; counsel's fees, auctioneer's

or valuer's fees; travelling or accommodation expenses; fees paid on

searches; costs of extracts from any register or record; disbursements

reasonably and properly paid and incurred (which is required to be itemised

in any bill); and cost of any extra work.

In your lawyer's bill you may see an item for miscellaneous charges in the

disbursement column. Such miscellaneous charges should not exceed RM50. If

your lawyer has itemised all the charges and disbursements incurred on your

behalf, then there should not be any more miscellaneous charges.

After your transaction has been completed you are entitled to ask your

lawyer for an account of actual disbursements incurred on your behalf. A

lawyer is required to return all unused disbursements to his client.

A lawyer may charge interest at 8% per annum on his disbursements and fees,

after one month from a demand made on his client.

The writer is the Deputy Chairman of the Conveyancing Practice

Committee, Bar Council, Malaysia www.malaysianbar.org.my |